Orthodontic care is essential for both kids and adults. But you can save money on your treatment with FSA. So, get the most out of your Flexible Spending Account (FSA) before 31st of December today. This Art of Smile Philadelphia blog covers every detail about the account, its benefits, and tips for using your FSA for Orthodontics smartly before its expiration.

What is Flexible Spending Account?

FSA for orthodontic treatment allows you to manage your orthodontic expenses with tax benefits. It is a benefit that allows you to set aside a portion of your income to manage your healthcare expenses. The amount of money you spare is tax-free.

Although FSA funds are beneficial for your dental and financial health, it has a downside also, if there is any unspent money in your account at the end of the year, it could be forfeited. In some plans, you get a grace period.

What Orthodontic Treatments are Eligible for FSA Benefits

You must know what your FSA plan is eligible for.

- Initial consultation: When you start your dental treatment, it is the first phase where you start spending your money, but if you will take FSA benefits, you will start saving from the very beginning of your treatment.

- Traditional Braces: Ceramic braces, traditional braces, lingual braces, and metal braces are all qualified for FSA coverage.

- Aligners: Aligner treatments also qualify for FSA benefits.

- Retainers: They are used as part of orthodontics treatment and are used to maintain alignment of the braces are covered in FSA plans.

- Treatment Related Supplies: FSA funds make you save on essential items used in treatment, such as retainers, aligners, orthodontic wax, and special cleaning supplies are also covered.

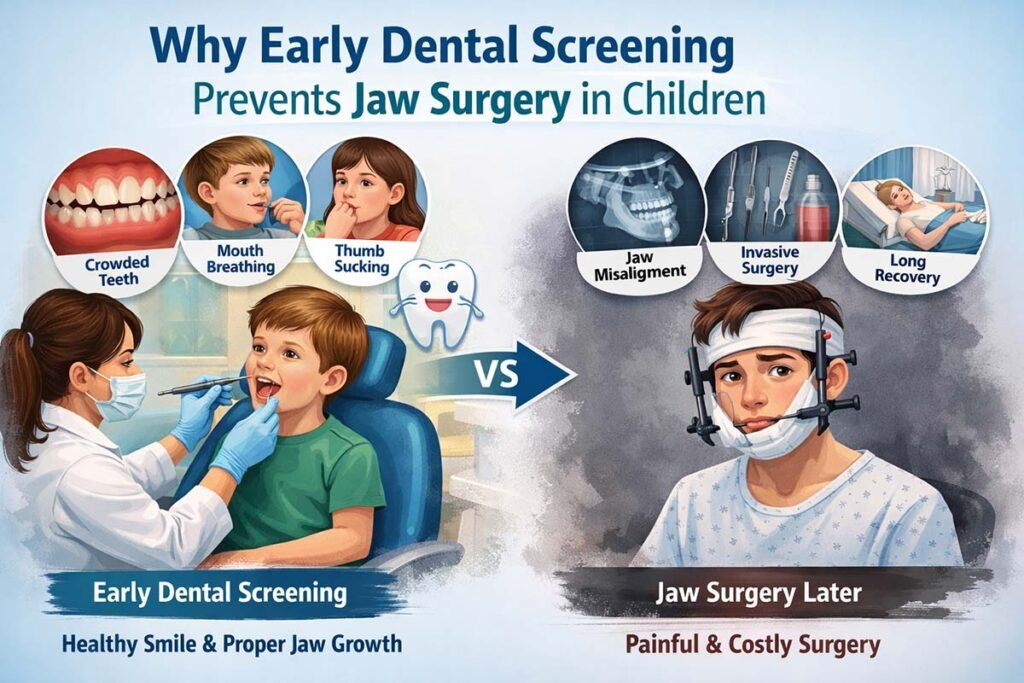

- Early Orthodontics: This is a phase 1 orthodontic treatment, which you can start with your kids.

Carefully make a check on your FSA plan and the treatments it covers. You can take a consultation session before enrolling.

Deadline Alert! Increase your Orthodontic Savings Before December 31st

The end of the year is a critical financial deadline for FSA. You must consider the “use it or lose it” FSA rules, which means any unspent amount left will be forfeited. To escape the situation, you can make a strategy with the following action plan.

Step 1: Make your Balance & Deadline Verification

Note your exact balance in your FSA plan, and confirm the deadline generally is 31st December. Check for the grace period, if any and fsa orthodontics reimbursement options available.

Step 2: Check Orthodontic Eligibility

Make sure to make confirmation about the treatments your FSA plan covers. You must know your plan in detail. By knowing so, you can make full amount elections for the whole year, and this will ensure the entire amount usage, till the end of the year.

Step 3: Orthodontist Consultation

Schedule a consultation with your orthodontist and request her to break down the total cost of the treatment and tell her you want to use your FSA fund before the end of the year.

You can also coordinate with your insurance. Look at how much portion of the amount you can adjust with your annual insurance policy.

Step 4: Prepayments Strategy

Many orthodontic FSA providers allow you to make prepayments for next year’s treatment. Ask your provider about such availability.

For example, you are left with 1200 $ in your FSA account and the treatment cost is $3500, you can pay a downpayment of $1200 using your FSA funds before 31st December. Now you are required to pay her $2300 only.

Step 5: Utilize Funds to Manage Related Eligible Expenses

If you are left with a small amount of FSA balance, i.e., not sufficient for full dental treatment, you can make use of that fund to buy eligible supplies like therapeutic mouth rinse, special dental wax, and prescription strength fluoride.

Step 6: Keep Documentation

Make sure to keep details of the expenses in the form of receipts or documents, which clearly shows the service you paid for and the date you paid on it. This documentation will help you get your FSA claims easily.

The window for 2025 is going to close very soon. Taking action now will help you prevent forfeiting valuable FSA funds.

Why Make Use of FSA for Orthodontics???

The most valuable advantage of using FSA for Orthodontics is paying for treatment with pre-tax dollars. Money you contribute to an FSA account is transferred without calculating a state and social security tax on it, so you receive an effective discount on the entire cost of treatment equal to the combined marginal tax rate.

Final Thoughts

Using a Flexible Spending Account(FSA) for orthodontic treatments is one of the smartest ways to save money on dental treatment. The major benefit you get from the investment is that you are not liable to pay any taxes on the funds you use as FSA funds. The only thing you must be aware of is the final deadline for using the fund. You must make sure to utilise the whole amount before the deadline; otherwise, the amount will be forfeited.

The Art of Smile Philadelphia has shared some valuable tips to get the maximum outcome from your FSA account. To know more on FSA plans, you can contact Dr.Kanchi Shah, an experienced orthodontist in the field.

FAQ’s

Can you use FSA for orthodontics?

Yes! FSA funds can be utilised for long term and short term orthodontic treatments.

Can I use my FSA for Invisalign or Aligners?

Yes! Clear aligner treatments are fully eligible for FSA funds as they are used for bite correction and to resolve bite issues.

Can I use my FSA for my child’s treatment?

Yes! FSA funds can be used for the qualified medical expenses of your kids, too.

What is the deadline for spending FSA funds?

The standard line is the last day of the plan year, which is generally December 31st.

Can I lose unspent FSA funds?

Yes! There are chances for forfeiting of FSA funds.